In 2020, more organizations than ever before made public commitments to decarbonize their business. Environmental, Social, and Governance (ESG) performance is now accepted as a key indicator of business health and long term financial viability. Increasingly, governments, investors, financial institutions and the general public are scrutinizing emissions and ESG performance to distinguish the leaders from the laggards.

Many companies historically are now starting to report their Greenhouse Gas (GHG) emissions under ‘Scopes’ dictated by the GHG Protocol. There are three separate Scope that have now been identified for reporting.

Scope 1 emissions (“direct emissions”) are directly related to the activity of a particular Company, while Scope 2 emissions (“indirect emissions”) are emitted from the consumption of purchased electricity, steam, cooling and heat.

Scope 3 emissions cover all indirect impacts of an organization both upstream and downstream not covered in Scopes 1 and 2. These emissions occur as a consequence of business operations from sources that are not owned or controlled by that business directly – such as from the supply chain, transport to operational sites or to customers, product use, and end-of-life treatment.

Scope 1 (direct emissions) and Scope 2 (indirect emissions) are the most easily measurable Scopes for GHG accounting and reduction, and the focal point for the start of any decarbonization journey. But for leading companies under investor pressure and looking to expand their impact, the evaluation and reporting of Scope 3 emissions are a complex issue to resolve. However, they do provide the opportunity to reach other emitters in their value chain – such as suppliers and customers – and influence them to reduce their emissions.

Some parts of a reported total for supply chain Scope 3 emissions will in fact be the Scope 1 emissions of those suppliers or customers, so that there is the real risk that those same companies will assume that their own emissions are already being accounted for, are worse they or deliberately do not report their own emissions as Scope 1 and thereby avoid the inevitable cost of decarbonisation, at least for now.

Although the reporting of Scope emissions is mostly voluntary at the moment, some countries such as the UK are starting to introduce mandatory reporting.

The reporting of Scope 1, 2 and 3 emissions by the largest quoted companies is being done primarily through corporate reports, since no centralised freely available resource yet exists for such information. Because climate change is considered a long term risk to companies the Scope values and the progress towards declared Net Zero Interim or Final Targets is often now included in the risk assessments of those companies. Furthermore, since there are long term costs for a decarbonisation pathway, those are included in the financial reports of that company as a declared financial liability.

It is certain that carbon accounting will be integrated with financial reporting going forwards. Companies that are making sincere and long term efforts to decarbonise their own operations and their connected supply chains are identified through those reports, but they are not easily available and take a long time to gather and analyse.

Several initiatives such as the CFP (formerly the Carbon Disclosure Project) are an available resource for Scope data, but they tend to be specific to a particular groups of countries of economic blocs such as the EU, and as such are not and will not be used by companies in countries that wish to have their own ways to monitor the progress towards Net Zero Targets.

The Net Zero Matrix has been conceived a one-stop shop where validation of reported data can be made by a group of companies in a particular sector, and where relevant Scope data can be easily seen and accessed through distributed identical ledgers rather than from centralised databases in a particular country.

The Carbon Footprint (CFP) is the sum of the Scope 1, 2, and 3 emissions for any particular reporting period, data is now being published by those companies as part of their Corporate reporting obligations on at least a yearly basis, and often in the same document as the financial reporting. Climate Change is being viewed as a Risk to the company going forwards, and since there is a cost to bear in any decarbonisation effort, it is effectively a liability on the asset sheet from a financial point of view. For a company that is well advanced with their Net Zero Target and who has reported a large cumulative reductions in the CFP, it is likely that this decarbonisation progress would be actually be considered to be an Asset on the balance sheet, but no mechanism currently exists to evaluate those cumulative reductions, and compare them against other companies or an ISIC Sector Benchmark. The Net Zero Matrix Carbon Register will enable such evaluations and comparisons to be done very quickly and transparently.

Other registers of CFP data such as the CDP lack the ability to enable the calculation and evaluation of related Key Performance Indicators (KPIs), and in particular have a focus in only certain parts of the world. The Net Zero Matrix Carbon Register is designed to be truly global in nature and provides real KPIs rather than subjective evaluations which lead to a Company ‘rating’ such as AAA for some and F for others.

Currently much of the data that has been recovered from online corporate reports is available only as PDF files or other online documents, an the data held therein is therefore essentially unstructured in form and cannot be easily used in any national or global carbon accounting until it has been transferred into a structured format such as in a relational database or distributed ledger.

The Net Zero Matrix data management team has gathered information manually from the same sources as other registers have done, but as companies register on the Net Zero Matrix Carbon Register they will be able to verify the data and KPI calculations and then subsequently send further Scope updates using an online form that will then automatically update the Register and related KPIs.

The Net Zero Matrix Carbon Register already includes the CFP data of thousands of companies in all different Industry Sectors. Initially this information has being collected manually from the corporate reports of those companies, and in the future we will adopt forms that will enable companies to report their yearly information directly into the Carbon Register, so than cumulative carbon emission reductions will be automatically updated into the distributed ledgers.

The actual status of the companies identified and those for which Scope information has been collected can be seen on the main page of this website, and some basic Key Performance Indicators (KPIs) are available here.

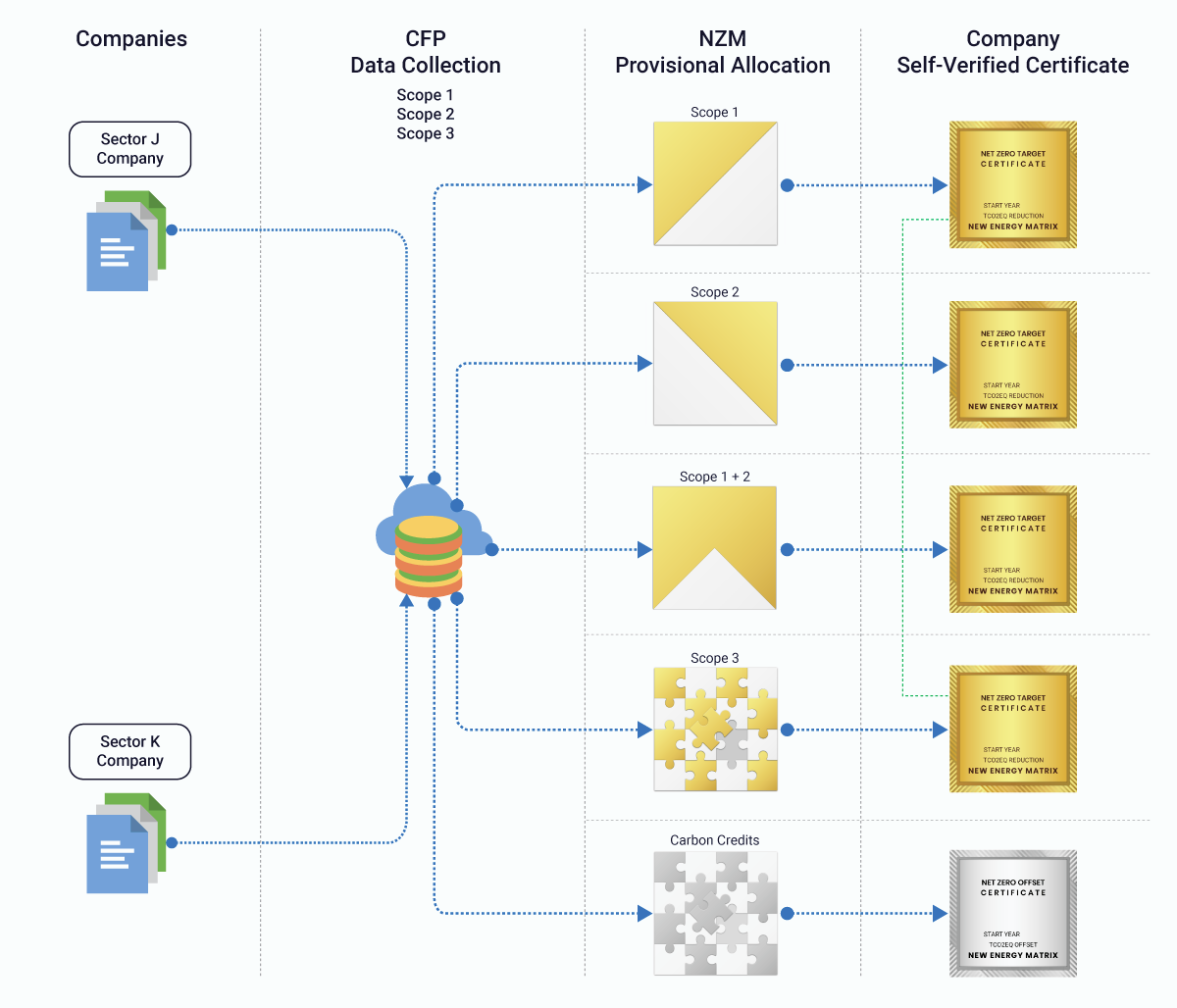

The Net Zero Matrix Carbon Register workflow can be seen here:

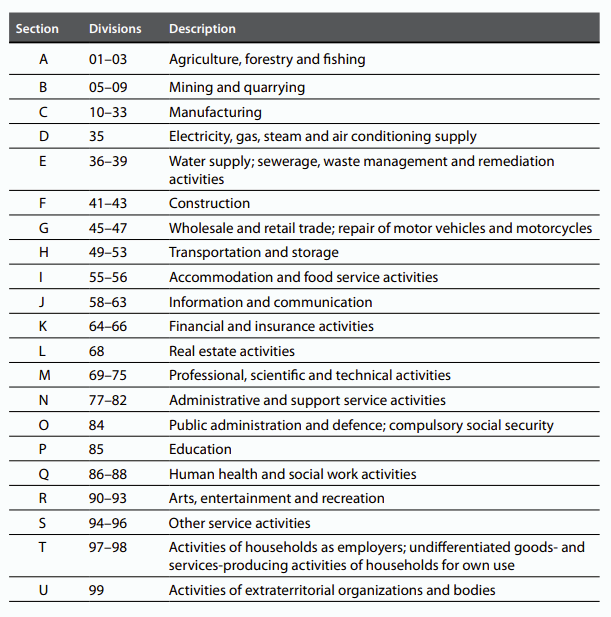

Data is collected from companies which are identified within a particular business Sector as defined through the International Standard Industrial Classification (ISIC) of all Economic Activities.

Page 58 of this document shows the broad structure of the ISIC categories:

In the workflow above we have shown Data for companies in Sector J (Information and Communication), and Sector K (Financial and Insurance activities).

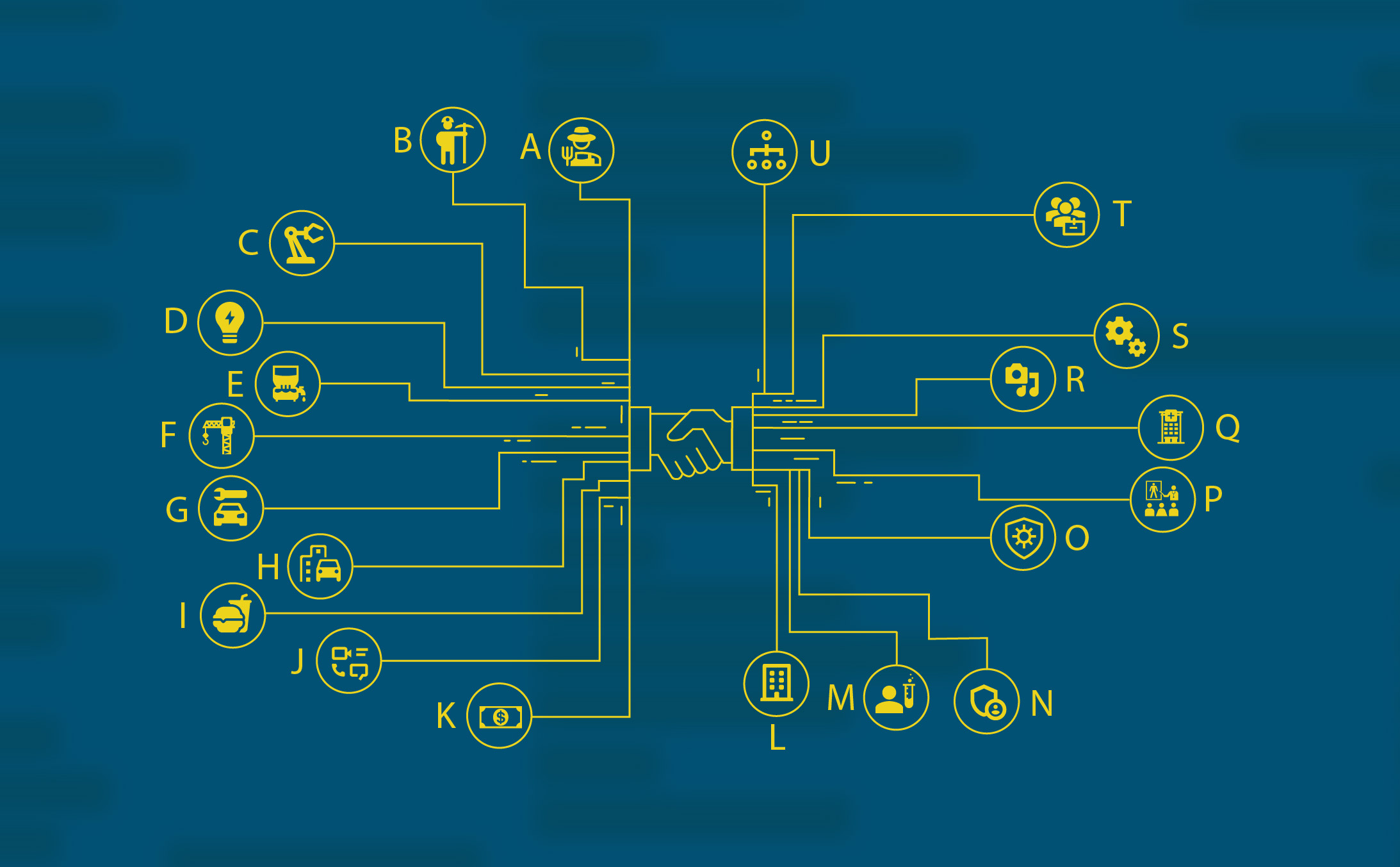

The contributions of these different Sectors is also shown in the following diagram:

Different Sectors have their own Carbon Footprints and those may also overlap. For example, Financial Institutions invest in all of the other Sectors. Such ‘Financed’ or ‘Portfolio’ emissions are a significant contribution to Scope 3 global emissions, and are these are a particularly complex issue when it come to Carbon Accounting.

There are several different ways in which companies are contributing towards the challenge of meeting their Net Zero Targets.

By definition, moving towards Net Zero requires companies to reduce their Absolute Carbon Emissions. Although the end objective for companies who have set Targets is to reduce those emissions to Zero in line with the objectives of the Paris Agreement, most have set an Interim target to reach a certain reduction percentage in emissions by the year 2030 or 2035, and the reported information in their corporate reports is based upon those initial objectives.

Typically Absolute Emissions are all measured in the same units, which are Tonnes of Carbon Dioxide Equivalent (tCO2eq). The main KPI that is calculated and displayed in the Carbon Register Public Page is the Cumulative tCO2eq that have been reduced since the target start date, and the Net Zero Efficiency (NZE), which is the progress towards the target.

The total Cumulative reduction that is achieved by a Company is an excellent good reflection on the progress, but it is difficult to compare it with other companies in the same sector, since they will have different sizes. We would expect that larger companies would probably have larger footprints and therefore be able to make larger reductions as they move along their decarbonisation pathways.

It is wit this in mind that Net Zero Matrix are calculating and displaying what they call the ‘Net Zero Efficiency’. Simple stated, this is the reduction of the CFP against the target expressed as a percentage:

Net Zero Efficiency (NZE) = (Actual CFP Reduction) / (Initial CFP ) * 100

This KPI therefore enables shareholders, investors, credit rating agencies, banks and many others to not only monitor the absolute reduction in the CFP, but also the relative progress along the pathway.

By having the Actual CFP Reduction and the NZE for as many companies as possible in any one particular Sector, it is possible to create benchmarks against which they can be measured. This provides a level playing field for all. It is not the intention of Net Zero Matrix to evaluate these KPIs and make subjective analysis of a ‘Carbon Rating’, as is done by other agencies such as the CDP. Instead, we are providing all relevant data in a single repository and thereby allow shareholders, investors, credit rating agencies, banks and many others to make their own direct evaluations, and not be obliged to accept the carbon ratings of others.