What is XBRL reporting format?

XBRL , Inline eXtensible Business Reporting Language is a newer version that enables a computer and human readable format of your data. In a standard web browser the information looks like a regular report, but using an inline viewer software, you can view contextual and tagged information or eXtensible Business Reporting Language is a XML based format for business reporting or exchange that is computer readable. Adopted for decades by multiple regulators across the world as a medium for financial reporting, there is now significant interest to use this for sustainability reporting.

Check if your jurisdiction uses XBRL here.

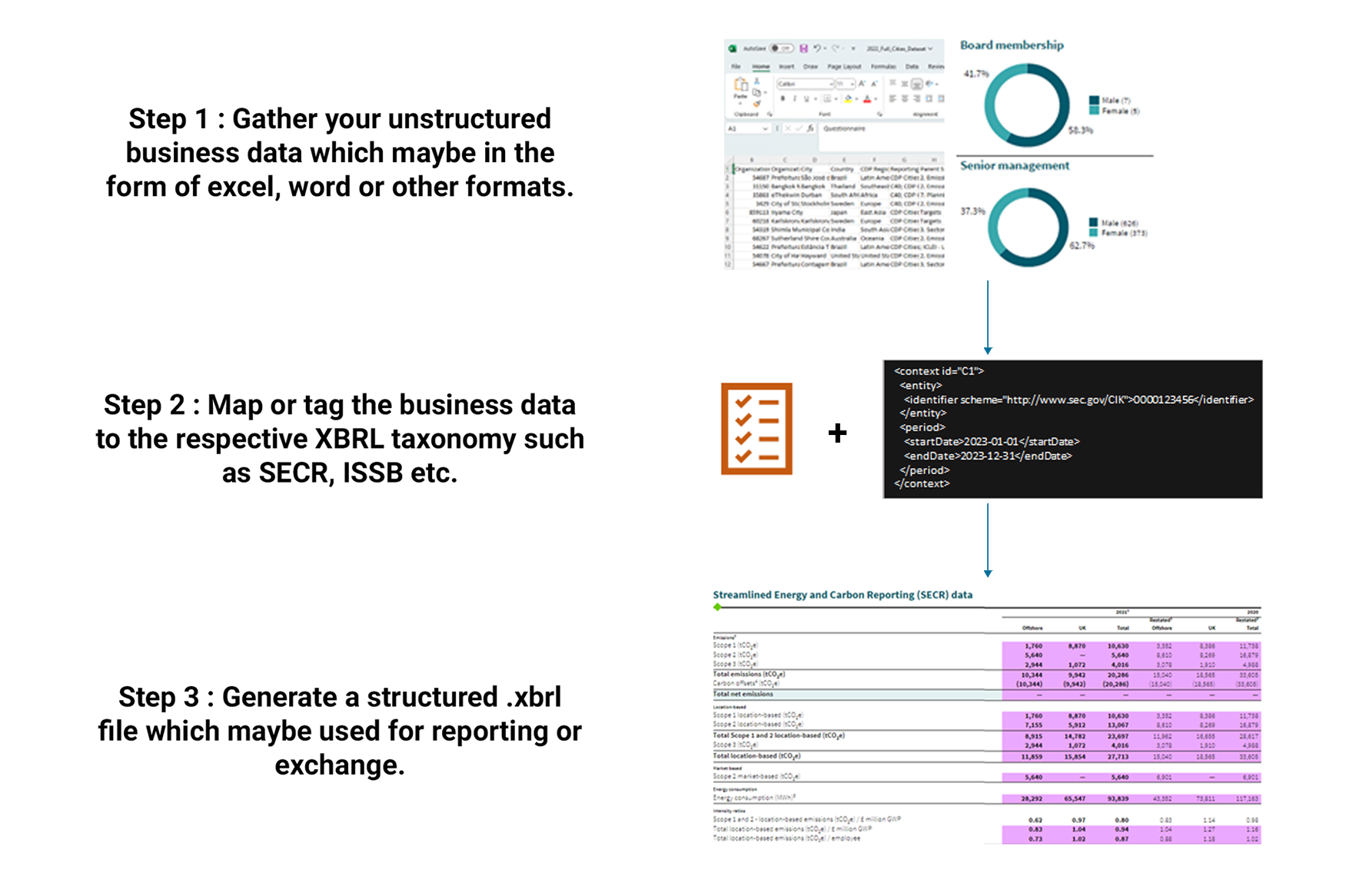

How does it work?

How can we help?

Through our user friendly platform, we help you to generate reports whether for regulatory reporting or for information exchange with ease and an expert team to support your needs.